Blog

Blog

IRS Announces 2024 Rate for Affordability Calculations

The Internal Revenue Service (IRS) has announced the 2024 indexing adjustment for the percentage used under the Affordability Safe Harbors under the Affordable Care Act (ACA) for plan years beginning in 2024. The percentage that should be used for 2024 plan years is 8.39% (which is down from 9.12% in 2023).

There are three “safe harbors” for affordable employer-provided coverage under the ACA: the Federal Poverty Level Safe Harbor, the Rate of Pay Safe Harbor and the W-2 Wages Safe Harbor. An employer must meet one of them to show that the coverage it has offered employees is affordable.

Under the Federal Poverty Level Safe Harbor, the maximum amount an employer can charge for self-only coverage and still be affordable on a CALENDAR YEAR PLAN will be $101.93 per month for employees working in the contiguous U.S. (DOWN from $103.28), $127.31 per month for employees working in Alaska (DOWN from $129.12), and $117.25 per month for employees working in Hawaii (DOWN from $118.78). The maximum amount an employer can charge for self-only coverage and still be affordable on a NON-CALENDAR YEAR PLAN is still to be announced. While non-calendar year plans can also use the calendar-year figures, the 2024 Federal Poverty Guidelines are expected to be published around the third week of January and, depending on inflation and other factors, this will likely mean that plans renewing on or after the date they are released will have a slightly higher threshold available to them. Stay tuned for that threshold amount when it becomes available.

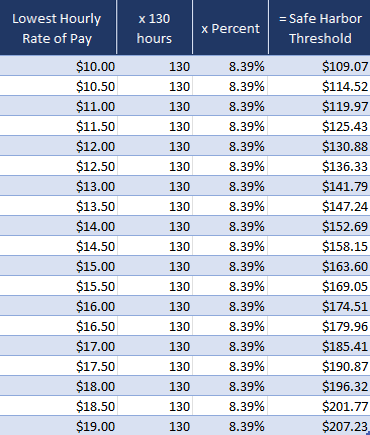

Under the Rate of Pay Safe Harbor, the maximum amount an employer can charge for self-only coverage and still be affordable is based on the employee’s lowest hourly rate of pay or salary, as the case may be. Specifically, the offer of coverage to a non-hourly employee will be treated as affordable for a calendar month if the employee’s cost does not exceed 8.39% of 1/12 of their annual salary. Likewise, the offer of coverage to an hourly employee will be treated as affordable for a calendar month if the employee’s cost does not exceed 8.39% of their lowest hourly rate of pay times 130 hours, as follows:

Please note that the lowest hourly rate is the employee's lowest hourly rate of pay as of the first day of the plan year, unless the rate of pay is reduced, in which case the lower amount is used. In other words, a raise given to an hourly employee after the first day of the plan year will not increase the threshold under this safe harbor until the following plan year, whereas a mid-year decrease in hourly rate will decrease the threshold for that individual as of the first day of that month containing that new lower rate of pay.

Under the W-2 Wages Safe Harbor, the maximum amount an employer will be able to charge for self-only coverage and still be affordable is based on the employee’s Box 1 income from their 2024 IRS Form W-2. Specifically, the offer of coverage is treated as affordable for employees who were employed in each 12 months of 2024 and also who were eligible for coverage for all 12 months of 2024 if the employee’s annual cost in 2024 does not exceed 8.39% of their annual Box 1 income. A similar formula is used for employees who were not eligible or were not employed for all 12 months of 2024, whereby the amounts used are prorated.

Subscribe

Subscribe to the Keenan Blog