Briefing

Briefing

Updated 2026 Benefit Limits for Health & Welfare Plans

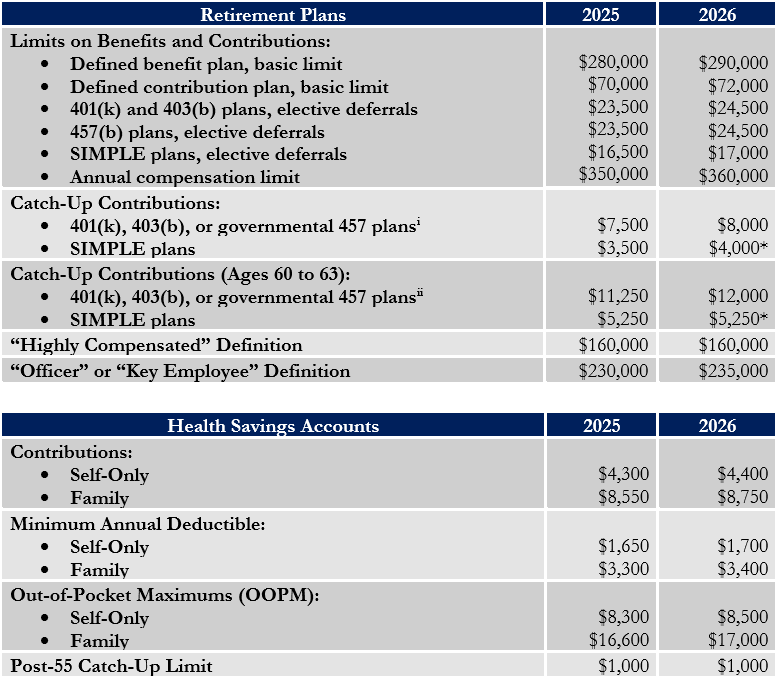

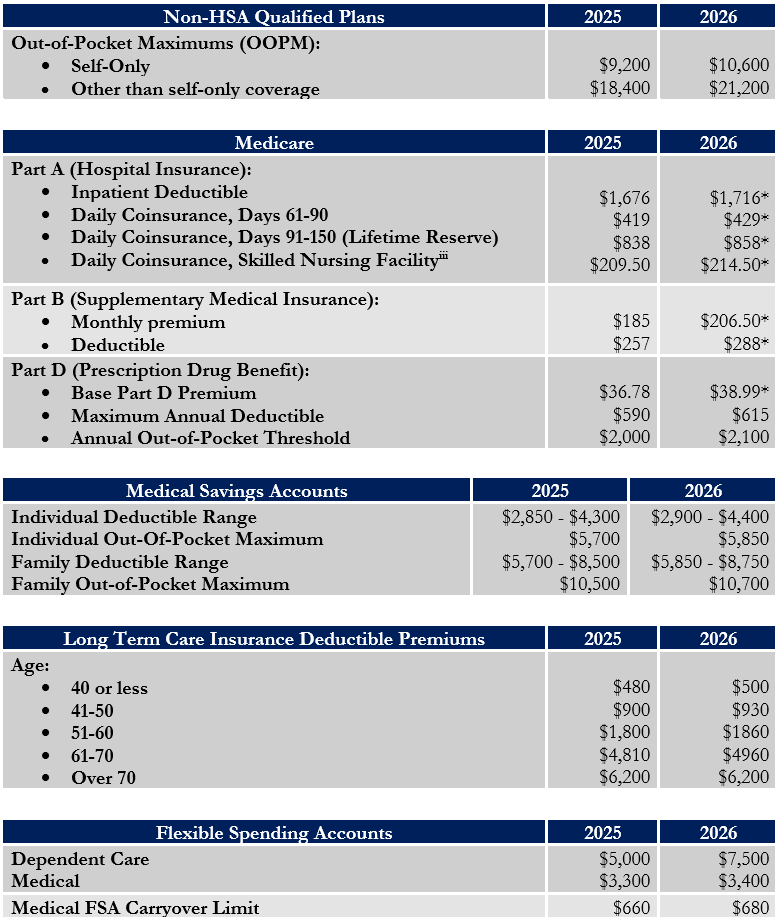

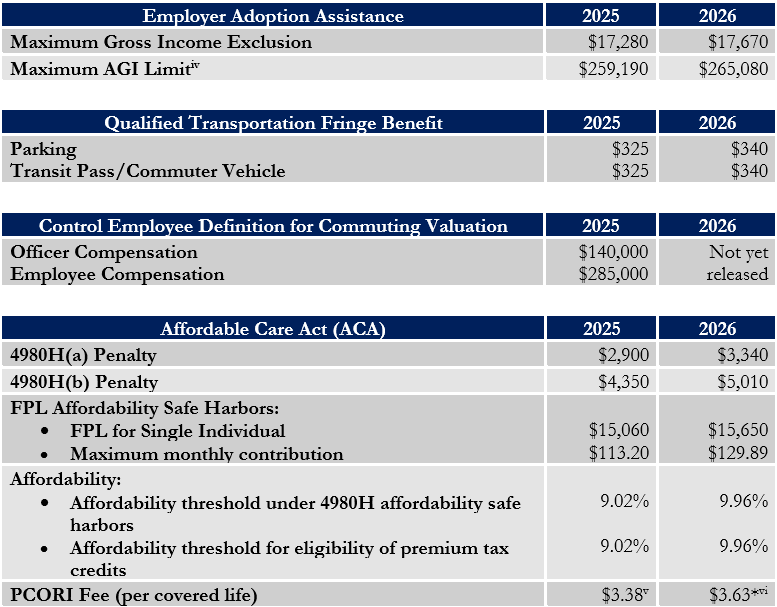

Every year, the U.S. Government sets new limits for various benefit programs to reflect inflation and changes in the law. Following are the limits announced for 2026 (amounts marked with an asterisk (*) are projected amounts). When those amounts are finalized, we will update this briefing. Employers should review their benefit plans to ensure they reflect these new limits.

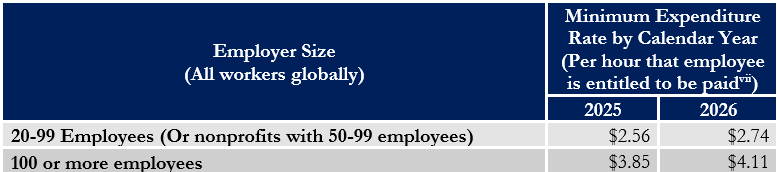

SAN FRANCISCO HEALTH CARE EXPENDITURE RATE INCREASE

The San Francisco Health Care Security Ordinance (HCSO) has released the updated minimum health care expenditure rates for 2026, requiring employers with San Francisco-based employees to comply with these new standards. Employers must spend a specified amount on health care for each covered employee, and only certain expenditures such as payments for health services, insurance premiums, and self-insured plans for employees and their dependents count toward the requirement. After premium rates for fully insured plans are set, plan sponsors should review and address any shortfalls to meet the minimum expenditure rate for each employee. Following are the current and upcoming health care expenditure hourly rates:

Exemption Threshold: Starting January 1, 2026, managerial, supervisory, and confidential employees who earn more than $128,861 per year (or $61.95 per hour) are exempt.

Please contact your Keenan Account Manager for questions regarding this briefing.

[i]Under SECURE Act 2.0, beginning in 2026, for those earning at least $145,000 in the prior year, indexed for inflation, catch-up contributions must be Roth.

[ii] Under SECURE Act 2.0, beginning in 2026, for those earning at least $145,000 in the prior year, indexed for inflation, catch-up contributions must be Roth.

[iii] For days 21-100. Days 1-20 is $0 for each benefit period.

[iv]After limit is reached, exclusion phases out.

[v]For plan years ending on or after October 1, 2024 and before October 1, 2025.

[vi] Projected for plan years ending on or after October 1, 2025 and before October 1, 2026.

[vii] Capped at 172 hours per month.

Keenan is not a law firm and no opinion, suggestion, or recommendation of the firm or its employees shall constitute legal advice. Clients are advised to consult with their own attorney for a determination of their legal rights, responsibilities, and liabilities, including the interpretation of any statute or regulation, or its application to the clients’ business activities.

Subscribe

Subscribe to the Keenan Blog