Blog

Blog

What Does the 2024 ACA Affordability Decrease to 8.39 % Mean to You? How Will It Affect Your Health Plans?

As a result of the IRS’ updates released last week in Rev. Proc. 2023-29, here are the key facts and take-aways that are most likely to impact the employee-facing costs for your Employer sponsored 2024 health/prescription drug plans. There are three “safe harbors” for affordable employer-provided coverage under the ACA: the Federal Poverty Level Safe Harbor, the Rate of Pay Safe Harbor, and the W-2 Wages Safe Harbor. An employer must meet one of them to show that the coverage it has offered employees is affordable.

- 2024 ACA Affordability Percentage Decrease to 8.39%: For the second year in a row, the IRS has announced a decrease in the ACA affordability percentage used to determine compliance with the employer mandate. The new rate of 8.39% is another reduction from 2023’s rate of 9.12% (which was also a decrease from 2022’s rate of 9.61%). This rate is the percentage of the employee’s household income that a person can spend while allowing the employer to call the plan “affordable” under the ACA.

- 2024 Lowest-Cost Plan is no more than $101.93 per month (Federal Poverty Line Affordability Safe Harbor): Calendar year plans offering a medical plan option in 2024 that costs employees no more than $101.93 per month for employee-only coverage will automatically meet the ACA affordability standard under the Federal Poverty Line Affordability Safe Harbor that deems coverage affordable for all FTEs (Full-Time Employees), and permits the employer to use Qualifying Offer method for streamlined ACA 1094 reporting.

- Please note that for employees working in Alaska the rate is $127.31 per month, and the rate in Hawaii is $117.25 per month.

- When your 2024 Lowest-Cost Plan Exceeds $101.93 per month, consider using the Rate of Pay Affordability Safe Harbor. Employers that do not offer a medical plan option meeting the 2024 federal poverty line affordability safe harbor (i.e., the lowest-cost plan option at the employee-only tier costs employees more than $101.93 per month) should generally utilize the Rate of Pay affordability safe harbor. This approach applies an analysis of the lowest hourly rate of pay for hourly full-time employees and the lowest monthly salary for salaried full-time employees. While the calculation is straightforward and mostly routine now, employers should plan and prepare now to ensure they keep their plan “affordable” at the reduced rate of 8.39% for 2024.

As noted above, the IRS’ issuance of Rec. Proc. 2023-29 significantly decreased the ACA-Affordability percentage to 8.39% for plan years beginning in 2024. 2020 and 2021 saw higher rates at 9.78% and 9.83%, respectively. But, beginning with 2022’s plan year, the IRS reduced the rate to 9.61% and then reduced it again to 9.12% for 2023. With 2024’s rate at 8.39% we see pricing at its lowest levels ever.

Employers should be actively preparing their 2024 contribution strategy with their broker/consultant team now to craft their approach to the ACA affordability safe harbor requirements. As employers work to determine and design their 2024 employee-contribution plan, they will want to work towards avoiding any “tack hammer” penalties (the ACA-employer-mandate “B-Penalty”). To combat this, employers should ensure that at least one of their medical plan choices made available to full-time employees across all regions does not have an employee share of the premium which exceeds $103.28 per month.

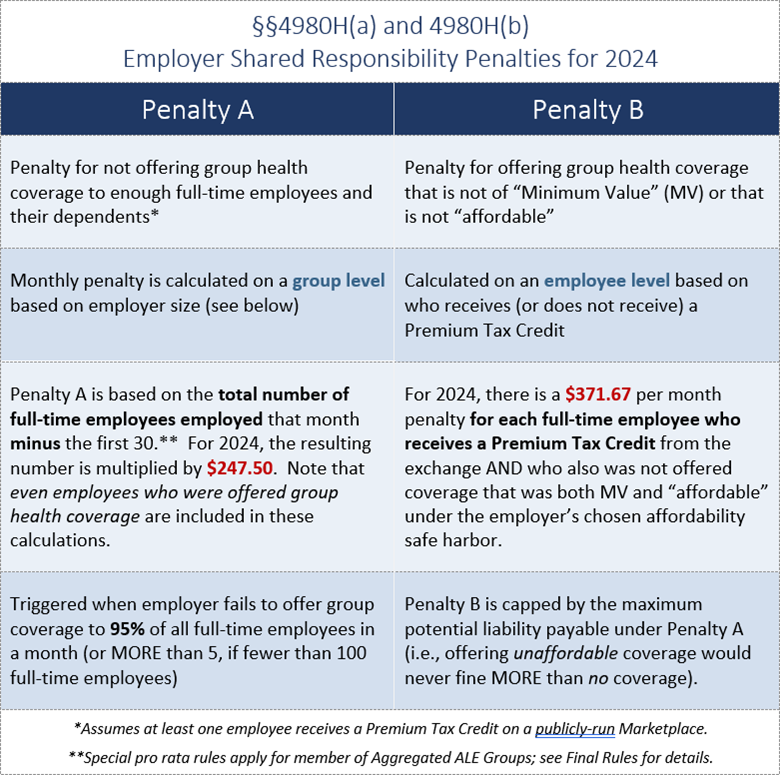

Affordability Mechanics – avoiding the IRC §4980H(a) – (“A Penalty” or “sledgehammer”) and avoiding the IRC §4980H(b) (“B Penalty” or “tack hammer”).

|

|

|

|

|

|---|---|---|---|

|

A Penalty |

$247.50/month (or $2,970 annually) |

$240/month (or $2,880 annually) |

$229.17/month (or $2,750 annually) |

|

B Penalty |

$371.67/moth (or $4,460 annually) |

$1360/ month (or $4,320 annually) |

$343.33/month (or $4,120 annually) |

The A-Penalty applies when an ALE fails to offer MEC (Minimum Essential Coverage) to at least 95% of its FTEs (Full-Time-Equivalent Employees as defined by the ACA) in any given calendar month. The penalty is $247.50 per month and is multiplied by all FTEs (minus the first 30). If just one FTE (who was not offered MEC) applies to and obtains subsidized-Exchange-based coverage, this penalty is triggered.

Whereas the B-Penalty applies where the ALE is not subject to the A-Penalty, but there was an FTE who was:

- Offered coverage that did not provide MV (Minimum Value)

- Offered coverage that did not provide MEC (Minimum Essential Coverage)

- Offered coverage that did not meet ACA-Affordability standards

The Inflation Reduction Act of 2022 (IRA) and the American Rescue Plan Act of 2021 (ARPA) expanded the ACA-premium-tax-credits when they eliminated the upper income limit and decrease the percentage of household income required to be contributed for Marketplace (or Exchange-based) coverage. As a result, through 2025, we can expect to see reductions to the ACA’s Affordability percentages.

Please reach out to your Keenan Representative or Keenan Account Manager to discuss your approach to ACA Compliance regarding meeting MV, MEC, and ACA Affordability for your plans. As your partners in risk-avoidance, our goal is to help you craft affordable, high quality plans that will properly meet your organization’s cultural needs, values, and budgets.

Links:

2024 ACA-Affordability update in IRS Revenue Procedure 2023-29

2024’s ACA Penalties for Penalty A and B

2023’s ACA-Affordability update

Subscribe

Subscribe to the Keenan Blog